With the increasing demand for businesses that offer delivery services, understanding the International Fuel Tax Agreement (IFTA) requirements is an essential part of success.

Companies engaged in this type of work must learn how to accurately track and report the fuel they use while crossing state lines, as well as the fees associated with doing business in each state.

This article will help provide delivery businesses with a much-needed guide to navigating IFTA requirements in order to reduce costs and gain efficiency.

It will cover everything from setting up the necessary paperwork to filing the correct quarterly reports, arming you with all the knowledge needed for successful IFTA compliance.

Introduction to IFTA Requirements

If you drive a commercial vehicle that crosses state lines in the United States, you are likely familiar with the International Fuel Tax Agreement (IFTA). This agreement set in place specific requirements to ensure the fair taxation of motor fuels transported across different states.

Bearing such regulations in mind is essential for any business as IFTA audit penalties can be harsh and may even include imprisonment in certain cases.

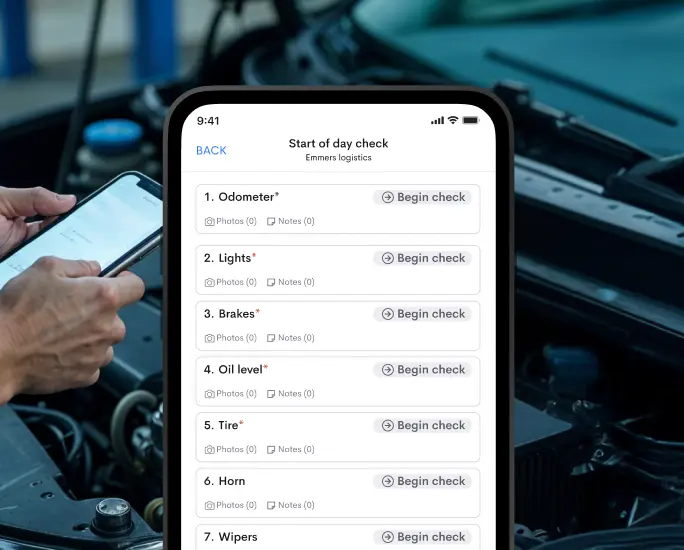

In order to remain compliant with IFTA regulations, each vehicle needs to have individual decals and maintain accurate records of fuel purchased and used during the year.

Preparing for regular audits is also critical as it helps prove that operations are up to date and within acceptable parameters. As a whole, understanding the importance of meeting IFTA requirements is crucial for anyone operating commercial vehicles on interstate highways.

What are IFTA Requirements?

If you own a vehicle and want to drive it across state lines within the United States, you may need to sign up for the International Fuel Tax Agreement (IFTA).

This is an agreement between all 50 states that allow commercial trucks and buses to purchase fuel in one state and transport it across another one without having to pay multiple taxes.

In order to qualify for IFTA, you must register the vehicle in an IFTA member state.

To stay compliant, you’ll also need to submit quarterly tax statements that include various records such as fuel receipts, mileage logs, and vehicle registration information.

With this paperwork in hand, businesses can ensure they’re upholding their duty of filing taxes while limiting the amount of time they spend completing tedious paperwork.

How Delivery Management Software Simplifies IFTA Requirements

Here are some ways in how a delivery management software can simplify IFTA requirements:

Automated tracking of fuel usage

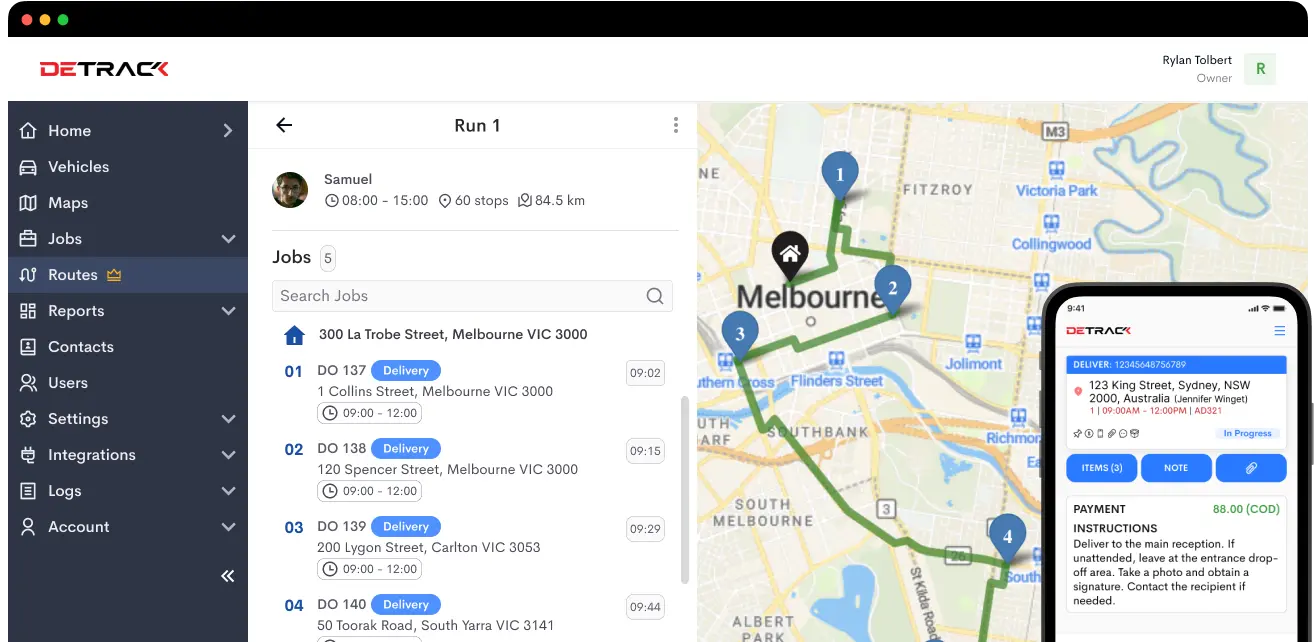

Delivery management software has revolutionized the process of tracking fuel usage during cross-border operations. By streamlining the logbook and IFTA filing processes, fleet owners can keep costs low, quickly identify errors, and increase operational efficiency.

With automated tracking tools to process innumerable data points across multiple legs in multiple jurisdictions, delivery management software provides instant access to accurate mileage calculations for optimized route planning and unexpected expense forecasting.

Additionally, useful features like fuel price analysis or custom reporting enable fleets to monitor the full cycle of their operation: from budgeting to filing taxes.

Efficient record-keeping

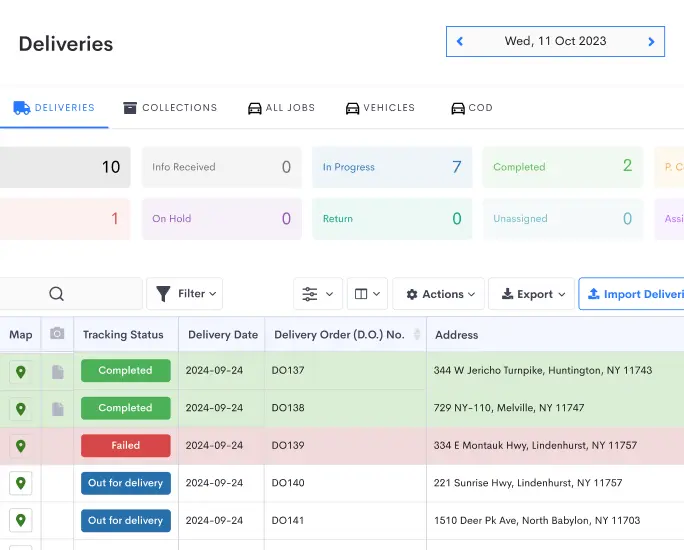

For transportation companies that frequently operate across state lines, keeping track of IFTA (International Fuel Tax Agreement) requirements can prove to be a tedious task. However, delivery management software simplifies this process by allowing the user to store IFTA and other information in one place.

This system can suitably keep records of when vehicles are on the road, how much fuel is consumed during trips, as well as any other necessary data related to a company’s fleet of vehicles. All of this information is organized in an efficient manner and is easily accessible for reference at any given time.

Furthermore, all tax reports can be generated from the same database – saving users hours of paperwork and manual tracking. While there may be different methods for keeping records, using delivery management software facilitates stress-free record-keeping for IFTA requirements and keeps revenue running smoothly.

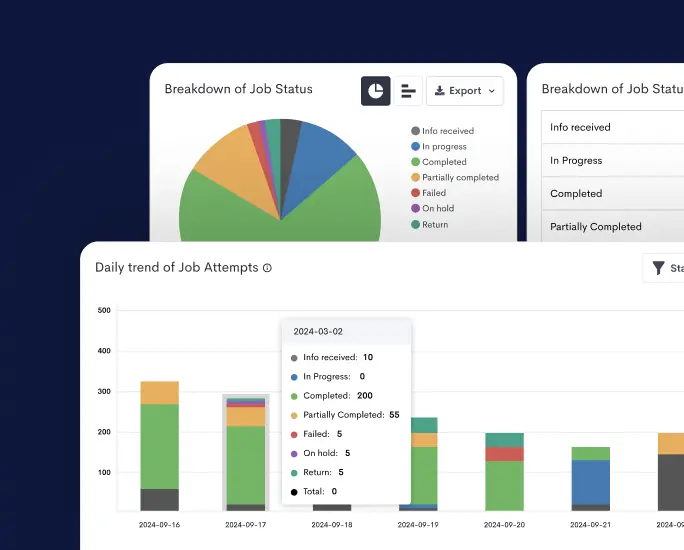

Accurate calculation of fuel tax liability

Delivery Management Software makes the obligations of Interstate Fuel Tax Agreement compliance easier than ever. From tracking miles driven in each state and more, it can quickly and accurately calculate your fuel tax liability keeping you up to date with all IFTA reporting needs in minutes.

No longer do businesses have to tediously log every trip, ensure they are accurately recording activity and manually enter that data into a spreadsheet in order to meet requisite deadlines.

By reducing time spent on record keeping, businesses free up personnel to focus on other areas of their business. Delivery Management Software is the ultimate solution for hassle-free IFTA compliance.

Easy IFTA reporting

Delivery management software provides a comprehensive and easy-to-use way for businesses to meet and exceed their IFTA requirements. The software simplifies the tracking of distances traveled, fuel used, taxes imposed, and other related data needed to comply with IFTA regulations.

Through their user-friendly interface, users can quickly and accurately glean up-to-date information about their fleet’s activity from virtually any device or location.

This takes away the headache of manual inputting or searching for information that can be tedious or overwhelming, instead allowing users to quickly monitor the state of their business, no matter how large or small it is.